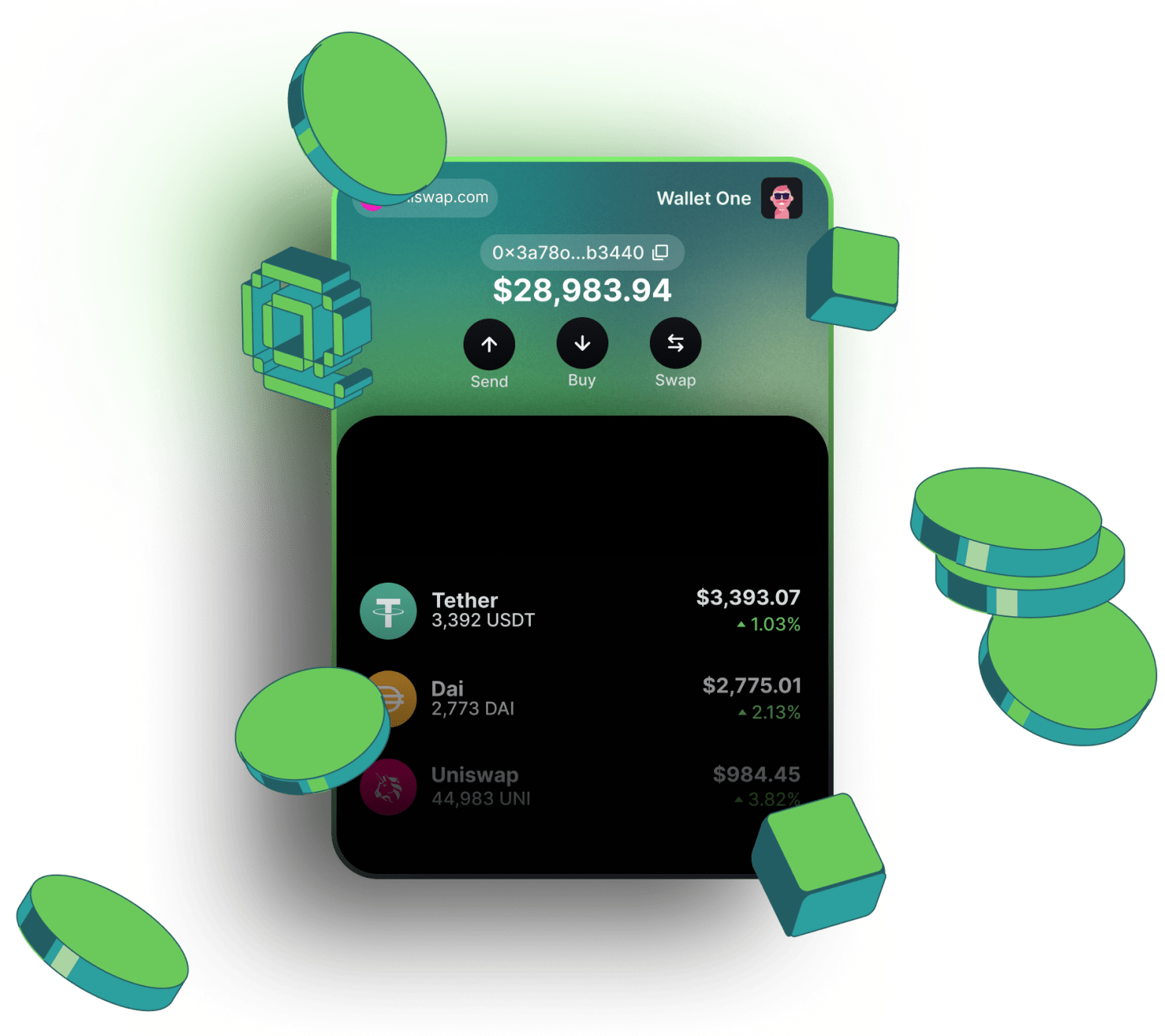

Wigwam is the best  Sonic blockchain crypto wallet

Sonic blockchain crypto wallet

Why choose the Wigwam crypto app?

Work with Sonic Testnets and Mainet

Buy Sonic tokens, including native token, by using a credit card

Swap Sonic-based tokens directly in the wallet

Possibility to connect the wallet to all Sonic blockchain dAps: DeFi, DAO, Gamings, etc

How to get a Sonic address in Wigwam web wallet

Create a wallet in Wigwam

Choose a Sonic network from the dropdown menu

Copy you Sonic address

Review of Sonic blockchain

Sonic is a new-generation blockchain positioned as a high-performance, EVM-compatible Layer-1 network. It was created as an evolution from the Fantom ecosystem, aiming to deliver extremely fast transaction speeds, low costs, and a developer-friendly environment. Its primary design goal is to overcome the limitations of older EVM chains, such as Ethereum, while still maintaining full compatibility with existing Ethereum tooling and smart contracts.

EVM Compatibility

One of Sonic’s strongest advantages is its full Ethereum Virtual Machine (EVM) compatibility. Developers can migrate or deploy their existing Ethereum applications directly on Sonic without needing to change code. This means all Solidity and Vyper smart contracts, as well as tools like MetaMask, Hardhat, and Truffle, work out of the box. For teams building DeFi, NFTs, or gaming applications, this compatibility ensures an easy transition into Sonic’s faster environment.

Performance and scalability

Sonic places great emphasis on speed and throughput. It claims to handle hundreds of thousands of transactions per second with near-instant finality. This positions it as one of the fastest EVM-compatible chains available. Its consensus mechanism builds upon the lessons learned from Fantom’s Lachesis protocol, optimized for higher efficiency and scalability. This performance focus makes Sonic appealing for large-scale decentralized applications, gaming projects, and enterprise-level blockchain use cases.

Cost efficiency

Transaction fees on Sonic are designed to be very low, which reduces barriers for both developers and users. Unlike Ethereum, where gas fees can spike dramatically during high demand, Sonic’s architecture ensures stable, predictable, and affordable costs. This is particularly important for microtransactions, GameFi mechanics, and DeFi protocols that require frequent contract interactions.

Developer ecosystem

Sonic actively positions itself as a developer-friendly chain. With full EVM support, existing Ethereum tools are immediately usable. In addition, Sonic offers grants, ecosystem funds, and incentives to attract developers who want to build innovative projects. Documentation emphasizes ease of deployment, compatibility with widely used libraries, and community support.

Use cases

The blockchain is designed to support a broad range of applications:

- DeFi: Yield farming, lending, and decentralized exchanges can benefit from its speed and low fees.

- Gaming: With near-instant settlement, Sonic can power on-chain gaming loops that would be impractical on slower chains.

- NFTs and Digital Collectibles: The cost efficiency makes NFT minting and trading more accessible.

- Enterprise Solutions: Businesses that require scalable smart contract infrastructure may find Sonic suitable.

Positioning in the blockchain landscape

Sonic differentiates itself from Ethereum Layer-2s by being a standalone Layer-1 chain rather than a rollup or sidechain. Compared to other EVM-compatible chains like Avalanche, BNB Chain, or Polygon, Sonic emphasizes extreme performance and throughput. It aims to attract projects frustrated with congestion and fees on other networks, while offering the familiarity of Ethereum tooling.

Pros

- Full EVM compatibility with zero migration friction

- Extremely high throughput and fast finality

- Very low and stable transaction fees

- Strong developer incentives and ecosystem support

- Broad applicability across DeFi, NFTs, and gaming

Potential challenges

- As a newer chain, Sonic needs to build a strong user and developer base to reach network effects

- Security and decentralization trade-offs need to be carefully monitored at high throughput levels

- Competition is intense, with many EVM-compatible chains fighting for the same developer attention

Conclusion

Sonic is positioned as a cutting-edge Layer-1 blockchain that blends Ethereum compatibility with unmatched speed and efficiency. By lowering costs and removing technical friction, it offers developers a high-performance environment for building next-generation decentralized applications. Its success will depend on adoption, ecosystem growth, and continued ability to differentiate from other fast EVM chains.

Sonic blockchain FAQ

Sonic is engineered to process hundreds of thousands of transactions per second with near-instant finality. This makes it significantly faster than most other EVM chains and suitable for high-demand use cases like gaming and DeFi.

Transaction costs on Sonic are extremely low and remain stable even during periods of heavy usage. This allows for affordable DeFi operations, microtransactions, and large-scale applications that would be too expensive on Ethereum.

Unlike Layer-2 networks that rely on Ethereum for security, Sonic is a standalone Layer-1 blockchain. This gives it more independence, higher throughput, and greater flexibility while still maintaining EVM compatibility for easy adoption.

Sonic was developed as an evolution of the Fantom ecosystem, with the team aiming to provide an even faster, more scalable infrastructure for Web3 builders.

Sonic leverages a consensus protocol inspired by Fantom’s Lachesis but optimized for greater scalability and parallel processing. This allows it to finalize transactions almost instantly while maintaining security.

Yes. Sonic uses a validator-based consensus mechanism that balances high performance with decentralization. Validators secure the network, and decentralization is an ongoing focus as adoption grows

Sonic’s advantage lies in combining extreme performance with full EVM compatibility. Unlike Solana, which requires learning a new programming model, Sonic allows Ethereum developers to migrate seamlessly. Compared to Avalanche, it emphasizes even higher throughput and faster finality.

On the Sonic blockchain, the gas token is $S (the Sonic native token).

Just like ETH on Ethereum or BNB on BNB Chain, $S is used to pay for transaction fees and smart contract execution on the network. Every interaction — from sending tokens, deploying contracts, to minting NFTs — requires a small amount of $S to cover gas.

Key points about $S as the gas token:

- Native Utility: It powers the network by paying for gas, securing validators, and enabling staking.

- Low Fees: Gas fees on Sonic are designed to remain extremely low compared to Ethereum, even during heavy activity.

- EVM-Compatible Use: Developers and users can interact with contracts just like they would on Ethereum, but fees are paid in $S instead of ETH.

- Network Security: Validators earn $S for processing and securing transactions.