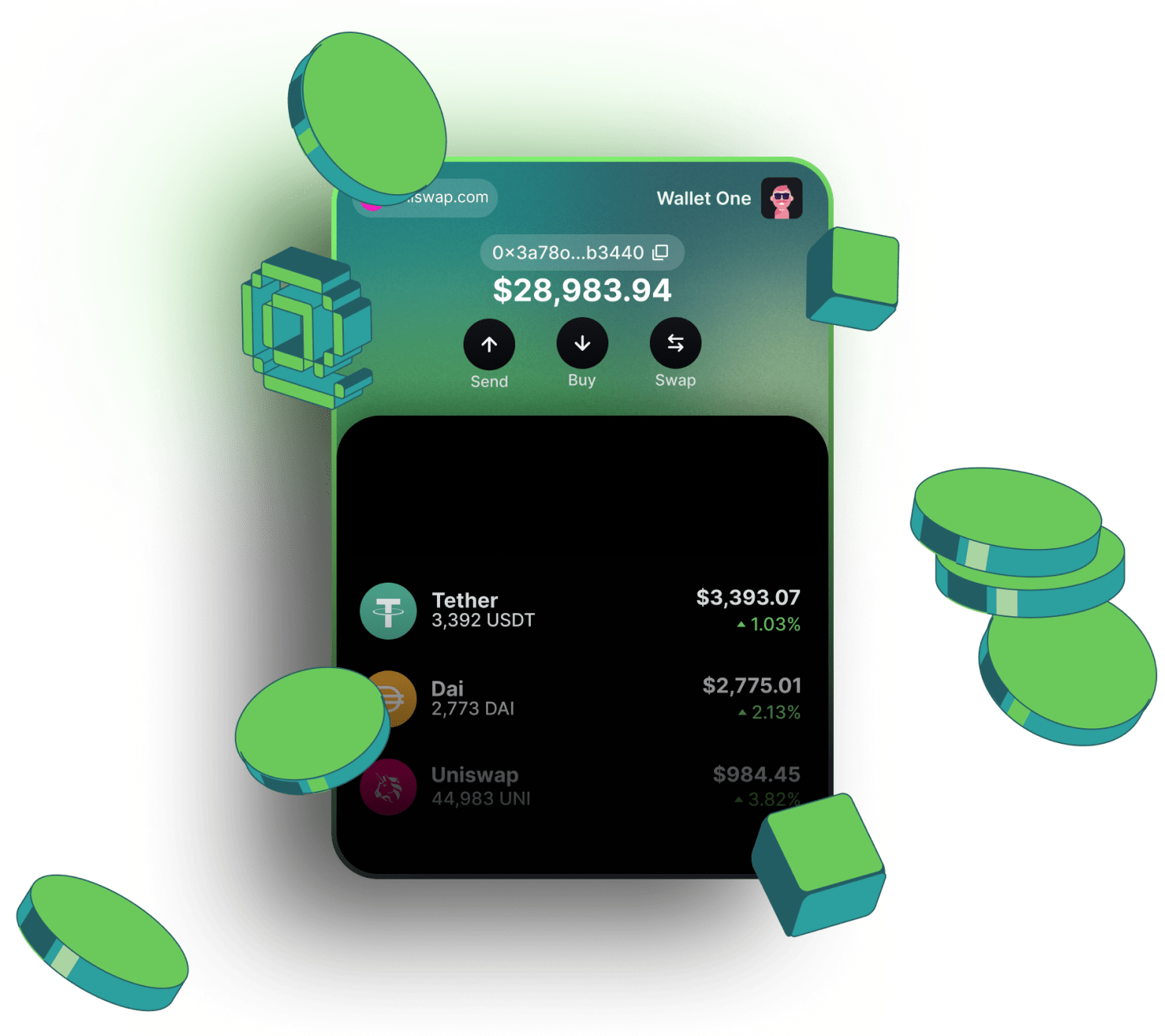

Wigwam is the best  Hyperliquid blockchain crypto wallet

Hyperliquid blockchain crypto wallet

Why choose the Wigwam crypto app?

Work with Hyperliquid Testnets and Mainet

Buy Hyperliquid tokens, including native token, by using a credit card

Swap Hyperliquid-based tokens directly in the wallet

Possibility to connect the wallet to all Hyperliquid blockchain dAps: DeFi, DAO, Gamings, etc

How to get a Hyperliquid address in Wigwam web wallet

Create a wallet in Wigwam

Choose a Hyperliquid network from the dropdown menu

Copy you Hyperliquid address

What is Hyperliquid?

Hyperliquid is a decentralized perpetual futures exchange (DEX) built atop its own Layer‑1 blockchain, uniquely combining the speed and usability of centralized exchanges with the transparency and security of DeFi

The platform's infrastructure centers around HyperEVM—an Ethereum-compatible execution layer—and HyperBFT, a custom consensus mechanism inspired by HotStuff that delivers sub‑second finality, ultra‑low latency, and massive throughput (up to 200,000 orders or transactions per second)

Hyperliquid strengths

Performance & speed

Hyperliquid offers sub-second transaction finality and order execution. It can handle up to hundreds of thousands of trades or cancellations per second. Orders, trades, and liquidations are all recorded directly on-chain, ensuring transparency.

Advanced trading features

The platform supports perpetual futures, spot trading, and leverage (up to 50× on certain pairs). It provides professional tools like stop-loss orders, TWAP, and advanced margin management. The design resembles centralized exchanges but remains trustless and self-custodial.

User experience

One-click trading is possible without constant wallet confirmations. Transactions are extremely low-cost or gas-free, making the platform smooth for active traders. The interface is intuitive for experienced users and supports a wide range of tokens such as BTC, ETH, SOL, AVAX, and more.

Community-driven tokenomics

Unlike many competitors, Hyperliquid has no venture capital funding. The governance token, HYPE, was distributed mostly to the community. HYPE is used for staking, governance, and rewards, with revenues fed back to users through rebates and incentives. This creates a long-term incentive structure that rewards traders and liquidity providers.

Security

Validator approvals are required for bridging and withdrawals, reducing the risk of unauthorized transfers. The protocol has undergone audits and maintains a bug bounty program. It has already demonstrated resilience during large withdrawal events without exploitation.

Hyperliquid weaknesses & risks

Validator centralization

The validator set is relatively small, raising concerns about decentralization. A malicious majority could potentially disrupt operations.

Not Yet battle-tested

Although stable so far, Hyperliquid hasn’t been through extreme market crashes or long-term stress tests like older blockchains.

Complex for beginners

The platform’s advanced trading features and derivatives focus may intimidate newcomers.

Limited fiat support

There are no direct fiat on-ramps; users must bridge crypto from other chains.

Oracle Dependence

The system relies on validator-run oracles for price feeds, which introduces some risk if they were ever manipulated.

Conclusion

Hyperliquid is one of the most innovative and promising DeFi exchanges today. It combines the speed and smoothness of centralized exchanges with the transparency and self-custody of DeFi. Its custom-built blockchain, on-chain order book, and user-friendly design make it stand out in the derivatives trading space.

That said, it is still early-stage, with centralization and stress-testing concerns that traders should keep in mind. For advanced users seeking fast, decentralized futures trading, Hyperliquid is an excellent choice and could become a leading player in the DeFi ecosystem.

Hyperliquid blockchain FAQ

The native gas token of the Hyperliquid blockchain is HYPE. It is used to pay for transaction fees, participate in governance, and access various platform features. Staking HYPE can also provide rewards and fee rebates.

You can track your wallet activity through the Hyperliquid block explorer or directly inside the Hyperliquid platform interface. Transactions, order placements, liquidations, and rewards are all recorded transparently on-chain.

The most commonly used wallets are Wigwam App and MetaMask and other EVM-compatible wallets, since Hyperliquid runs on an Ethereum-compatible environment (HyperEVM). Hardware wallets like Ledger can also be connected for added security.

The core project is the Hyperliquid Perpetual Futures Exchange itself, which is the first fully on-chain order book DEX with advanced derivatives trading. The ecosystem is still young, but additional DeFi apps, staking platforms, and liquidity vaults are beginning to emerge around it.

Yes. Hyperliquid is designed for high-performance trading with sub-second transaction finality and the ability to process hundreds of thousands of orders per second, making it significantly faster than many Layer-1 and Layer-2 solutions.

While the platform is optimized for advanced traders, beginners can also use it. However, because it focuses heavily on derivatives and leverage, new users should start with spot trading and small amounts before moving into advanced features.

Users can earn by staking HYPE tokens, providing liquidity in vaults, or participating in community reward programs. Traders also receive fee rebates and incentives based on their activity.

Yes, but with some caveats. Hyperliquid uses a validator network for consensus, and while it is expanding, the validator set is still relatively small compared to older blockchains. Governance through HYPE aims to increase decentralization over time.

The chain is audited and has a bug bounty program. Transactions are transparent, and cross-chain bridging requires validator approval, which reduces risk. While it has performed well so far, it’s still newer and has not yet gone through the same stress tests as long-established blockchains.