Wigwam is the best  Solana blockchain crypto wallet

Solana blockchain crypto wallet

Why choose the Wigwam crypto app?

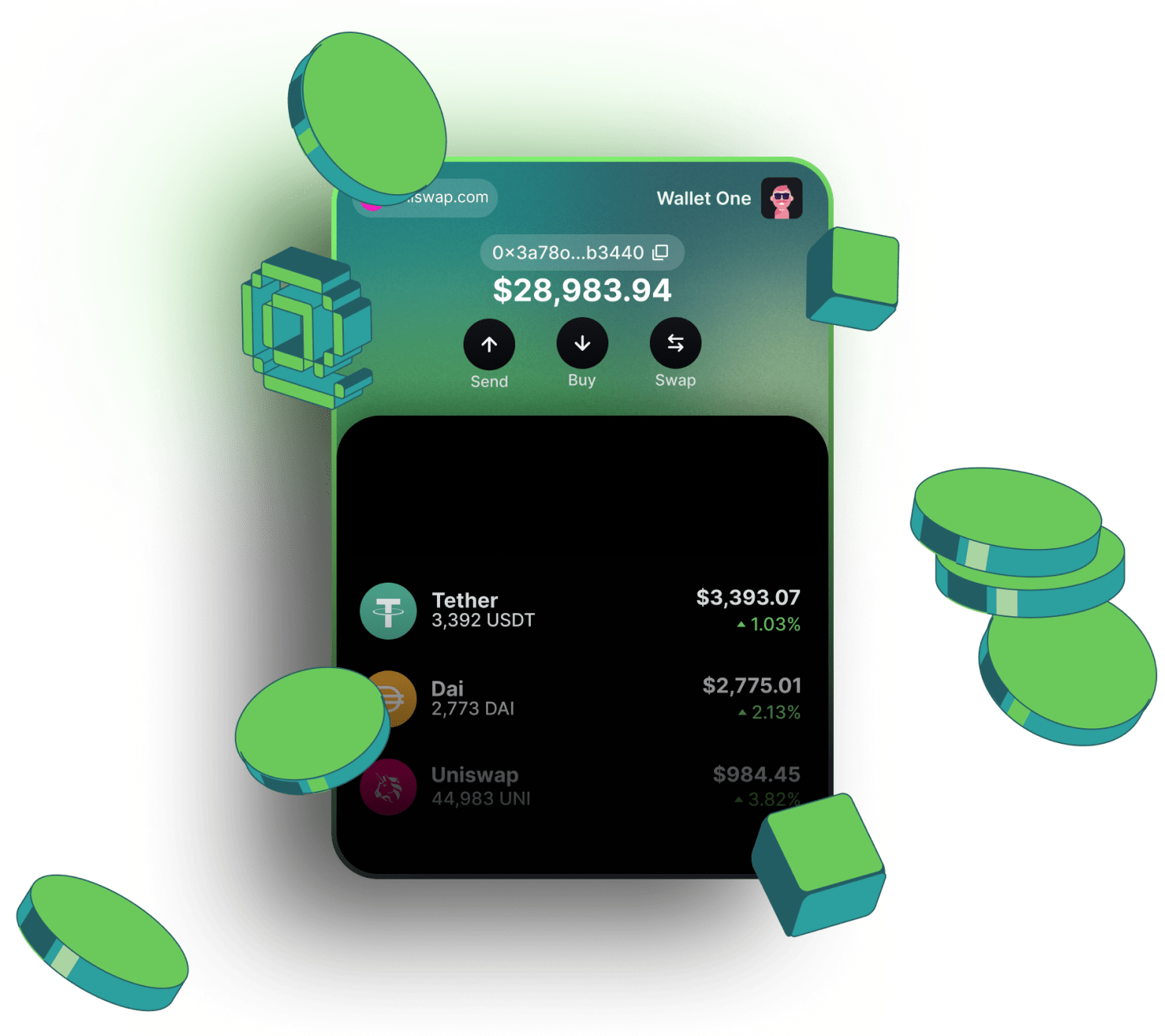

Work with Solana Testnets and Mainet

Buy Solana tokens, including native token, by using a credit card

Swap Solana-based tokens directly in the wallet

Possibility to connect the wallet to all Solana blockchain dAps: DeFi, DAO, Gamings, etc

How to get a Solana address in Wigwam web wallet

Create a wallet in Wigwam

Choose a Solana network from the dropdown menu

Copy you Solana address

Solana Blockchain Review

Solana is a high-performance blockchain platform designed for mass adoption and serves as a scalable battleground for nonprofits, enterprises, and billions of people worldwide with Internet connectivity. It acts as a single global state machine, with an emphasis on openness, interoperability, and decentralization.

Its scalability and user-friendly design are what make Solana very different from the rest, developers can build apps without the need to be optimized for the blockchain layer in order to reach millions of users. Solana also offers low fees and faster confirmation times (400ms), making it a very attractive ecosystem for building high-throughput decentralized applications.

History of Solana

Solana was born in 2017 when Anatoly Yakovenko (a former Qualcomm engineer) saw scalability problems with existing blockchains such as Bitcoin and Ethereum. He proposed the Proof of History(PoH) consensus mechanism to boost throughput and reduce transaction times. Together with Qualcomm engineers Greg Fitzgerald and Stephen Akridge, Yakovenko built the Solana protocol formerly known as "Loom" but rebranded to Solana. Solana Labs was formed in 2018 to create a high-performance blockchain that powers thousands of transactions per second.

Solana aims to be a scalable and efficient blockchain ecosystem with the best features for decentralized applications (dApps) with low transaction costs, and fast confirmation times. Promoted as a scalable blockchain technology platform, Solana’s performance focus aims to drive mass adoption of blockchain technology. The Solana Foundation cultivates this growth by leaning on community engagement & developer resources to build out a platform that rivals Ethereum in prominence, speed, and cost; earning the name "Ethereum Killer."

Key Milestones

Solana’s journey is full of milestones in ways that represent the growth and importance of Solana in the blockchain industry. Anatoly Yakovenko founded Solana in 2017 with the publishing of its white paper, introducing the killer feature of Solana, the Proof of History (PoH), to solve scalability issues present in blockchains like Bitcoin and Ethereum.

The project was originally titled Loom but later rebranded as Solana, the Solana lab had raised more than $20 million before 2018–19 to fund its development. In March 2020, Solana went official with its Mainnet Beta release; a landmark in going from theory to a fully operating blockchain that can both facilitate transactions and run smart contracts.

In 2020–21, the ecosystem grew rapidly with over 100 projects and began securing institutional investment. Nonetheless, in September 2021 the network experienced a major Denial-of-Service (DDoS) attack which resulted in high downtime revealing that scalability problems were apparent under heavy transaction loads.

Solana took a serious hit when FTX collapsed in 2022, but the Solana ecosystem started recovering by 2023. Solana also saw major names like Shopify and Visa integrate into its ecosystem, thus expanding its reach. Solana continues to evolve, bringing features such as state compression to save on storage costs. In March 2024, the SOL token broke past $200 demonstrating a strong rebound and reaffirming the stand of Solana amongst leading blockchain platforms.

What Consensus Algorithm Does Solana Blockchain Use

Solana utilizes a novel approach that uses Proof of History (PoH) in combination with the Proof of Stake (PoS) and Tower Byzantine Fault Tolerance (BFT), to gain high performance, scalability, and security.

Proof of History (PoH) works as a cryptographic clock that encodes time directly in the blockchain, removing the need for synchronized clocks among nodes. The PoH works on a high-frequency Verifiable Delay Function (VDF), where each hash output is fed into the next. This keeps track of the time passage and ensures that the order of events matches with real-time, improving the efficiency and scalability, by removing the constant need for messaging between validators.

Tower BFT is Solana’s implementation of Practical Byzantine Fault Tolerance, leveraging PoH as the global time source for reducing low-latency execution and improving network efficiency. Validators are divided into clusters, working in time slots with a designated leader for block production. If over two-thirds of the staked weight agree, the consensus is reached and the block is finalized by the cluster leader.

Solana uses a PoS approach to select validators, measured by the amount of SOL they have staked. Those validators with more at stake are more likely to be selected to validate transactions and get rewarded. The users can delegate their SOLs to the top validators, with a capping reward structure that incentivizes widespread participation as well as increasing network security.

By integrating PoH, Tower BFT, and PoS, Solana delivers fast transaction speeds of thousands a second at low fees using the most secure decentralized network through transactions. This all-new kind of consensus mechanism sets Solana worlds apart from the traditional blockchain components used for transactions.

How Solana Technically Solved Problems with Scalability, Decentralization, and Speed

Solana confronts the dilemmas of scalability, decentralization, and speed by utilizing an amalgam of unique technologies as well as architectural decisions.

Solana can theoretically process 65,000 transactions per second (TPS), one of the fastest-performing blockchains today and even outstripping legacy payment networks such as Visa. It is made possible by a novel set of consensus mechanisms (PoH, PoS, and Tower BFT) and an exceptional network design. Moreover, Solana's protocol is meant to take advantage of the hardware and bandwidth improvements; its transaction throughput capabilities double every two years in keeping with Moore’s Law.

One of the ways that Solana preserves decentralization is through incorporating Proof Of History (PoH) as a key component in its consensus mechanism. PoH is an agreed-upon digital history of events that can be verified by all members for consensus across a network facilitated without a central party. Validators are voted in by the staked SOL held there, where users can delegate their stake to a larger validator encouraging wider participation and decentralization.

Solana solves the issue of speed by making sure that all the nodes on its network have a synchronized time and reduces the processing power among them required to verify timestamps thus speeding up transaction verification. This is made possible by Solana using PoH with Tower BFT, a fast consensus mechanism to make sure transactions are processed quickly and at low latency.

Who are the Main Players in the Solana Blockchain

Validators, delegators, and cluster leaders are the pillars of the Solana blockchain ecosystem as they play crucial roles and need to be well coordinated in order for the network to work appropriately.

Validators: Validators process transactions; Maintain the blockchain and create new blocks using Proof of History (PoH) & Tower BFT. Validators are required to stake SOL as collateral, which is used to encourage honest behavior and protect the network against malicious activity.

Delegators: Delegators are users who stake their SOL to validators rather than running a node themselves. This enables them to earn rewards and support the security of the network, without the full technical responsibilities of a validator.

Cluster Leaders: Cluster leaders are chosen validators who oversee the consensus process during specific time slots. They create the PoH sequence, time stamp transactions, and assemble blocks to facilitate quick transaction processing.

DeFi Ecosystem on Solana Blockchain

Solana has a significant economic impact driven by its high transaction throughput and low latency which can process over 50k TPS with little to no delay as DeFi applications need quick action like trading and lending. In addition, Solana has extremely low transactional costs (often only a few cents) allowing a range of financial activities and for developers to leverage the margin from operational overhead.

The platform is interoperable with other blockchains and does strategic network collaborations. Empowering DeFi development promoting innovation and expanding liquidity. Consequently, the various DeFi protocols that leverage Solana, not only contribute to demand for its native token SOL but also support and advance the dominance of this blockchain in terms of performance as well as usage.

“Jupiter Exchange”, “Pump.fun”, “Solend”, “Marginfi”, and “Jito” are some of the top-performing DeFi in the Solana ecosystem.

NFTs Marketplaces on Solana Blockchain

Solana NFT marketplaces leverage high throughput, low fees, and smart contracts to encourage economic growth. Solana allows for nearly instantaneous, lag-free NFT trading that can handle thousands of transactions per second. Low transaction costs allow for inexpensive market buying and selling, while a variety of platforms, such as Magic Eden & Solanart provide diverse digital assets.

Solana’s interoperability boosts liquidity by allowing seamless cross-chain trades. Solana has positioned itself as a leading platform in the NFT space with automated royalties and secure transactions thanks to enhanced smart contracts.

“Magic Eden”, “Tensor”, “Moaar”, “DigitalEyes Market”, and “SolSea” are some of the top NFT marketplaces on the Solana Blockchain.

Tokenomics and Gas Usage on Solana Blockchain

At the heart of Solana's tokenomics is its native cryptocurrency, SOL — which has a number of different uses within the network such as:

Gas Fees: SOL tokens are used to pay for gas fees, which typically average between 0.0001 SOL – and 0.00015 per transaction. There is a base fee of 5,000 lamports (0.000000001 SOL) per signature and optional fees for prioritization during high-traffic

Fee Burning: Solana uses a deflationary model, where 50% of transaction fees are burned (i.e., removed from circulation), which in theory should lead to an increase in the value of SOL tokens. The other 50% is paid to validators, providing security on the network.

Rewards & Staking: Validators receive transaction fees and inflationary rewards, and users can delegate their SOL in order to secure the network, gaining a small portion of fees from transactions. This staking system serves to secure the network alongside promote user participation.

Governance: SOL holders exercise governance rights over the network, voting on updates and changes, thereby influencing the growth of this blockchain.

Rent Mechanism: Users are required to maintain at least 0.002 SOL per account to keep their active active. This helps manage storage efficiently with minimum charges.

Conclusion

One of the key blockchain in the crypto space world is Solana Blockchain, blending the fastest transactions with less cost and new-generation technology. What sets this blockchain apart is its one-of-a-kind consensus mechanisms and economic model which enables it to scale efficiently making it a good choice for many applications from DeFi apps all over the way through NFTs. As Solana winds its own way forward, the quality of its innovation and ecosystem suggests that it will continue to set its own course with ever-increasing performance across more parts of the blockchain landscape.

FAQ

Solana Blockchain utilizes its native token SOL, for gas fees.

Enter your public wallet address in the search bar of the Solana Explorer to gain access to all your account history and transaction specifics.

To keep your crypto transactions secure and safe, using a private crypto wallet for your SOL is the best practice. Wigwam Wallet, Exodus Wallet, Phantom Wallet, and Tangem Wallet are some noteworthy wallets to consider.

Many popular projects are running on the Solana blockchain, such as Marinade Finance, Orca, Solend, Tulip Protocol, Quarry, Sunny Aggregator, Open Ocean, and many more.

Many popular projects are running on ZetaChain, including EddyFinance, Zeta Earn, iZiSwap, OpenSea, Niftygateway, Mint Fun, MintBase, and many more.